November rate hike may have already slowed housing market

The RBA held the cash rate steady at 4.35% for its last meeting of the year. This was broadly expected as several data flows came in weaker through November. Retail trade fell -0.2% month-on-month, and although still low, the unemployment rate ticked up 20 basis points to 3.7% in October.

The monthly CPI measure also declined, but this may have had less influence on the RBA decision. That’s because October CPI was impacted by various subsidies, including the increase to the Commonwealth Rental Assistance, and excluded some services where inflation is more persistent. This gave a less clear read on inflationary pressures.

Offsetting the weaker data flows was a surprisingly strong month of housing lending in October, up 5.4% month-on-month. The uplift in lending may be short lived however, with CoreLogic currently estimating a month-on-month decline in sales volumes over November.

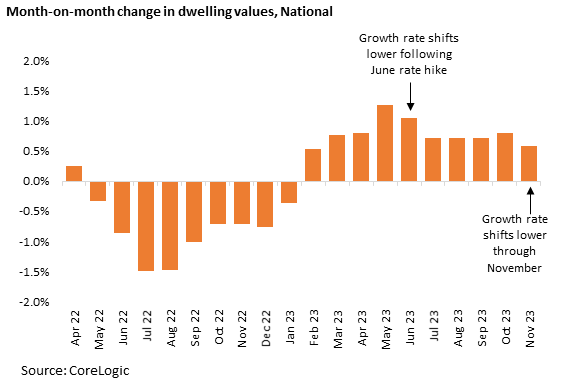

Recent market performance indicates that while housing has been surprisingly resilient this year in terms of capital gains, interest rate increases have had some impact. This is particularly the case where rate increases were unexpected. This was evident following the ‘surprise’ rate hike through June, and appears to have had some impact through November. CoreLogic’s national Home Value Index recorded its lowest monthly increase since February, with values up just 0.6% in November.

The slowdown in housing market performance has been led by Melbourne, where values actually fell -0.1% in November. Sydney also saw a marked slowdown in the rate of growth from 0.7% in October to 0.3% in November.

Rates are not the only factor slowing housing market performance, with stretched affordability and more normalised stock levels also having an impact.

New APRA data shows households continue to cope with high interest rates

Also released today was the September quarter property exposures from APRA. The data showed a continued resilience in households’ ability to service higher mortgage costs. Although rising, the non-performing loan rate lifted to a marginal 0.80% of outstanding housing credit. The portion of housing loans that were 30-89 days past due also increased, to just 0.54% of loans.

The resilience in mortgage serviceability may seem surprising given the sharp rise in mortgage rates since April 2022. Using the average owner-occupier mortgage rate reported by the RBA for September, and assuming the November rate rise is passed on in full, the average variable rate may now be around 6.25%. For a borrower with a $750,000 loan in April 2022, this has added an estimated $1,690 per month to variable rate mortgage repayments.

However, economic data suggests households are continuing to cope through reduced savings, potentially working more hours, and putting less towards mortgage savings buffers and more towards scheduled repayments.

The RBA Board will next meet in February 2024, moving to its new meeting schedule of eight meetings a year. The RBA has noted that whether further tightening In monetary policy was needed would be highly data dependent.