How a Title Search Protects You from Hidden Property Liens

When purchasing a property, ensuring that you have a clear and undisputed title is crucial for safeguarding your investment. One of the key benefits of conducting a title search is its ability to uncover hidden property liens. These liens can pose significant risks if not identified and resolved before the purchase. Understanding how a title search protects you from these hidden liabilities can help you make informed decisions and avoid potential complications.

What is a Title Search?

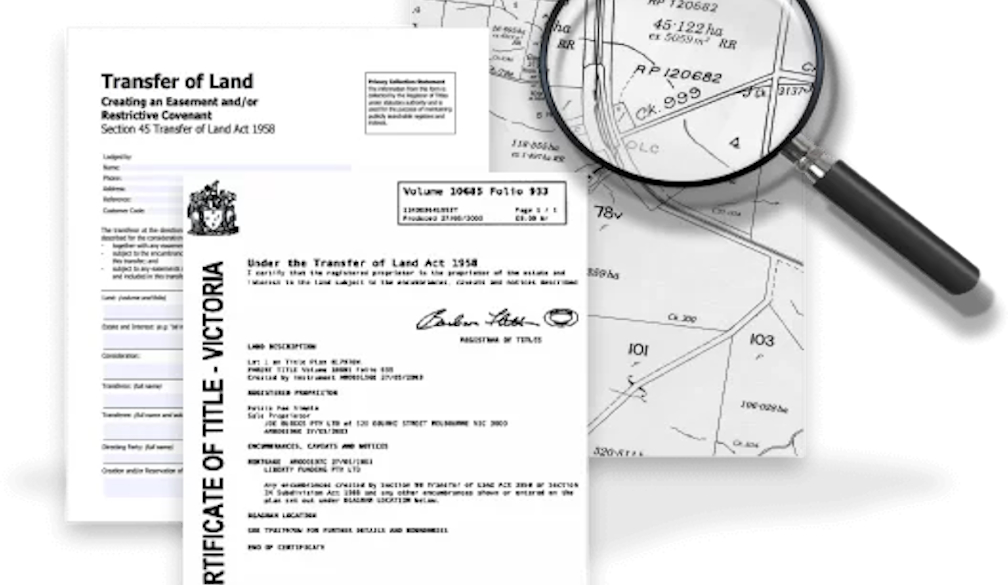

A title search is a detailed examination of public records related to a property’s ownership and history. The goal is to verify that the seller has the legal right to transfer ownership and to identify any existing claims, encumbrances, or liens against the property. By reviewing documents such as deeds, mortgages, and court records, a title search ensures that the property’s title is clear and marketable.

Understanding Property Liens

Definition and Types of Liens

A lien is a legal claim or encumbrance placed on a property to secure the payment of a debt or obligation. If a property has outstanding liens, the lienholder has a right to pursue repayment from the proceeds of a sale. There are several types of property liens, including:

- Mortgage Liens: These are claims placed by lenders who provide a mortgage loan. The property serves as collateral for the loan.

- Tax Liens: These are imposed by government authorities for unpaid property taxes or income taxes.

- Judgment Liens: These arise from court judgments against the property owner for unpaid debts or legal obligations.

- Mechanic’s Liens: These are filed by contractors or suppliers who have not been paid for work performed or materials supplied.

Risks of Hidden Liens

Hidden or undisclosed liens can be problematic for buyers. If a lien remains unresolved, it can affect your ability to obtain clear title and potentially result in unexpected financial burdens. For instance, you might be responsible for paying off outstanding liens if they are not identified and addressed before closing the transaction.

How a Title Search Identifies Hidden Liens

Comprehensive Record Examination

A title search involves a comprehensive review of various public records, including court documents, tax records, and property deeds. This examination helps uncover any existing liens or claims that may not be immediately visible. By identifying these liens, you can address them before finalising the property purchase.

Verification of Lien Status

During the title search, the status of each lien is verified to determine if it is still active or has been satisfied. This process ensures that any outstanding liens are identified and resolved prior to the transfer of ownership. For example, if there is an unpaid tax lien, it must be cleared before the property can be transferred to a new owner.

Benefits of Title Search in Liens Detection

Avoiding Financial Liability

By uncovering hidden property liens through a title search, you can avoid inheriting unexpected financial liabilities. Addressing and resolving these liens before closing ensures that you are not held responsible for debts or claims against the property. This proactive approach protects you from unforeseen expenses and legal complications.

Ensuring Clear Ownership

A title search helps ensure that the property you are purchasing has a clear and marketable title. By identifying and resolving any liens or claims, you can proceed with the transaction knowing that you are obtaining full and undisputed ownership. This clarity is essential for protecting your investment and avoiding future disputes.

Resolving Liens Identified in a Title Search

Working with Professionals

If a title search reveals hidden liens, it’s important to work with professionals such as real estate agents, lawyers, or title companies to resolve these issues. They can assist in negotiating with lienholders, settling outstanding debts, and ensuring that all necessary legal steps are taken to clear the title.

Obtaining Title Insurance

Once the title search is complete and any liens are resolved, obtaining title insurance provides additional protection. Title insurance covers any unforeseen issues that may arise after the purchase, including undiscovered liens or defects in the title. This insurance offers peace of mind and financial security in case of future claims.

Conclusion

A title search plays a vital role in protecting you from hidden property liens and ensuring a smooth real estate transaction. By thoroughly examining public records and identifying any existing claims, a title search helps you avoid financial liabilities and secure clear ownership of the property. Addressing any issues discovered during the search and obtaining title insurance further safeguards your investment and provides peace of mind. Whether you’re buying or selling property, understanding the importance of a title search can help you make informed decisions and protect your interests throughout the transaction process.