Savills Australian Student Accommodation 2023 report

BRIGHT FUTURE FOR STUDENT ACCOMMODATION SECTOR, SAYS SAVILLS REPORT

Leading real estate agency Savills’ latest Australian Student Accommodation 2023 Report has revealed that demand for Purpose-Built Student Accommodation (PBSA) remains at its most feverish point and tipped to further increase, continuing to outstrip supply amid low vacancy and a mounting number of offshore student arrivals.

The report highlighted an easing pipeline of PBSA development forecast to be delivered over the next three years, with the total number of new student beds dropping by more than 50% compared to the last three years. It also revealed that investors are shifting their focus away from the inner-city suburbs of Sydney and Melbourne and toward locations, such as Sydney’s northern suburb of Macquarie Park.

It also revealed that despite the slow delivery of new stock, as construction costs and the price of debt continue to hinder new developments. PBSA remains extremely attractive to investors due to its counter-cyclical benefits and strong returns, as evidenced by Blackstone recently purchasing the Student One portfolio.

“We anticipate that investors will continue to back student accommodation due to the capacity for rents to keep pace with inflation,” said Paul Savitz, Savills’ Director of Operational Capital Markets.

“An all-too-familiar imbalance of demand over supply is continuing to fuel strong annual rental growth in student accommodation over the short term, which we anticipate could, in some markets, still be double-digit in 2025,” added Mr. Savitz.

Data points to steady rental growth across major cities

The Savills Australian Student Accommodation 2023 Report forecasts that PBSA rental growth in Sydney is expected to outperform other cities over the next five years, benefitting from highly ranked universities – such as the University of Sydney and UNSW - an influx of lifestyle students, and a historic undersupply of accommodation.

Rents in Brisbane have increased the most over the past two years, rising by 50%, according to the Savills report. Rents are likely to slow over the next five years as new supply enters the market from 2026 and affordability ceilings are reached, although this is still significantly above historic rental trends.

|

|

Forecast 5 Year CAGR to 2029 |

|

Sydney |

6.1% |

|

Adelaide |

5.8% |

|

Perth |

5.8% |

|

Melbourne |

5.6% |

|

Canberra |

5.6% |

|

Brisbane |

5.4% |

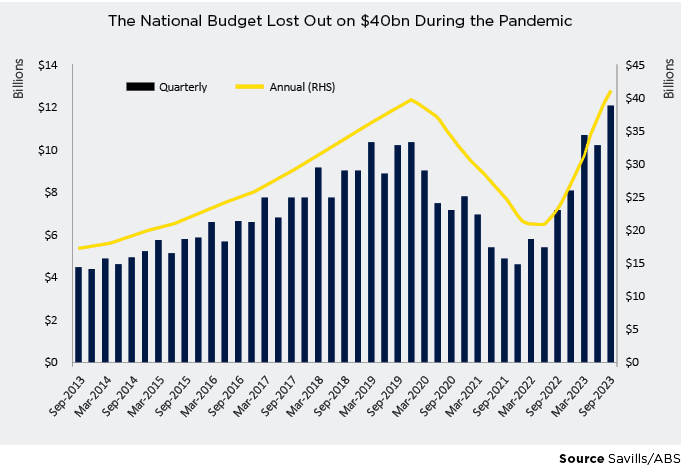

Higher education exports booming year-on-year

Savills’ Australian Student Accommodation 2023 Report found that international student arrivals to Australia are increasing at a rapid rate. In the year to September 2023, there were 618,350 international student arrivals to Australia, an 88% increase from the previous year. Savills says the international student arrivals forecast will surpass 2019 levels in 2024 and grow to close to one million by the end of the 2025 academic year.

“This boost in international student arrivals comes after Australian universities advised a return to in-person course delivery this year, with the Chinese government also requesting its students to return to destination universities. This catalysed a rapid bounce-back in demand for higher education in Australia, which has caught many universities by surprise,” said Mr. Savitz.

According to Savills, the relatively low value of the Australian dollar also makes living and studying in Australia cheaper for some overseas students, partly catalysing this increase in offshore enrolments.

Due to soft economic conditions and the stickiness of Australian inflation, most forecasts suggest that the AUD will continue to slide for the remainder of 2023, before the AUD will begin to appreciate against the USD over the next two years - potentially rising to 0.8 by the end of 2025.

However, Savills says this would still make the AUD some 15-20% below the most recent peak and should continue to make Australia an attractive educational export market for international students, keeping it competitive among international offerings.

On-campus supply quickly absorbed as market looks to private sector

The Savills Australian Student Accommodation 2023 report highlighted that ongoing low residential rental vacancy is creating pent-up demand for student accommodation across all major towns and cities.

Demand continues to outweigh supply as universities look to increase their intake of international students. Despite almost 79,000 PBSA beds now available across the inner cities of Australia’s eight capitals, with an additional 4,907 beds becoming operational in 2023, there is still a shortfall between supply and demand.

“A combination of a lack of knowledge, business case, land, and capital from the majority of universities is restricting the delivery of new on-campus accommodation,” said Mr. Savitz.

“The decisions, resources and outlook of private investors will therefore drive PBSA growth, and these investors must navigate economic, planning and delivery challenges, respond to shifting student demographics, and also champion environmental sustainability. Their choices, particularly regarding new developments, financing, and adherence to ESG principles, will ripple across the sector,” he added.

Supply pipeline a hurdle with focus shifting from gateway cities

Sydney and Melbourne have been the key focus of supply over the last three years, driven by their proximity to Group of Eight universities. Almost 100% of new beds scheduled to become operational in 2024 and 2025 are in Sydney and Melbourne - an indicator of real estate fundamentals and investor preferences during the pandemic.

“Land values in amenity-rich locations close to universities and public transport have maintained their value, impacting on the feasibility of schemes alongside build cost inflation and planning delays,” said Paul Savitz.

Investors are now seeking to unlock greater value in locations where market fundamentals are strong and demand and supply are imbalanced, but with no Group of Eight university nearby. According to the report, Savills expects a more balanced delivery of new student accommodation away from the global gateway cities of Sydney and Melbourne.

Australia’s changing economic landscape creates the need for careful consideration of investment and development strategy in the short term, says Savitz, with some investors shifting their focus towards locations with higher yields in the medium term.

Examples of investment in high-growth locations include Sydney’s Macquarie Park, where a combined total of over 1,200 student beds are earmarked for completion by the end of the 2026. Nuveen’s site purchase in Macquarie Park will see 488 beds delivered, with Centurion currently gaining planning approval for a further 732 student beds in the same suburb.

Savills has noted that Macquarie Park has not seen off-campus PBSA of institutional quality or scale delivered to date, with strong underlying growth fundamentals driving greater interest in the area.

In Western Australia, Australian Unity has teamed up with investment manager MaxCap Group to develop a $1 billion portfolio of student accommodation facilities as a seed asset for that venture. The partnership has seen the purchase of a site close to the new ECU Perth CBD Campus, which will deliver 732 beds.

Highlighting ongoing barriers to development, the future delivery of new beds remains significantly below previous levels.

Savills forecasts that just 7,770 new PBSA beds will become operational in Australia’s capital cities by 2027 - a 52% decline compared with the 2020-2023 period, and a 64% fall from 2018-2020 levels. The development of investor-grade residential apartments, an alternative for students, has also fallen to record lows at a time when net migration has reached record highs.

Savills highlights positive growth outlook for PBSA

According to the Australian Student Accommodation 2023 report, PBSA is a counter-cyclical sector that remains favoured by investors despite economic uncertainty, higher construction costs and the elevated cost of debt, because it offers consistent returns.

Conal Newland, Head of Operational Capital Markets, said, “Unlike many other real estate sectors, rents can be rebased every six months, or even every semester - keeping pace with inflation and adapting to a shifting economic environment. These features will maintain the comparative attractiveness of the sector for investors and may lead to a further rebalancing of real estate portfolios away from commercial assets and towards residential assets such as PBSA, supporting the sector’s continued growth.”

Investment activity across global student accommodation markets has followed wider real estate trends with YTD transaction volumes indicating decreased liquidity as uncertainty around yield pricing weighs on investor minds, notwithstanding rapid rental growth, high occupancy and increasing NOI.

“For Australia, the key constraint limiting student accommodation transaction volumes is the lack of properties offered to the market, as most operational assets are tightly held by a limited number of large-scale platform owners”, said Newland.

According to Newland, across the Australian student accommodation investment market there remains boundless optimism around equity and debt for financing new investments and refinancing stabilised assets.

“The availability of capital, both equity and debt, for development has been the biggest concern. This likely reflects a more conservative approach from investors and lenders with the current macroeconomic backdrop, and cost challenges continuing to face the construction sector. As a result, we have seen, and will likely see a slowdown of new development over the near term, further exacerbating the supply challenges facing the sector,” said Newland.

Savills Research reveals that rebooking rates for student accommodation are also on the rise. While prior to the pandemic, rebooking rates were around 30%, on-campus and off-campus providers now report significantly higher rebooking rates of up to 85%. Savills says the new norm appears closer to 40-45%, pointing to an undersupplied market.

This is good news for PBSA operators, as higher rebooking rates add additional revenue to the NOI profile due to less rental leakage to offshore channel agents or booking platforms.